Content

As an example, placing $5 with a good one thousand% extra contributes $50 within the extra fund, providing you with $55 total. To allege, create an account making very first deposit of at least $5. Abreast of this, you’ll discover you to definitely totally free spin of the Extra Controls. For your assistance inside saying procedure, service can be acquired. A cards relationship are a no more-for-money financial business in which customers are theoretically region residents.

It’s a highly good deal nevertheless, since you just need deposit one $5. Undoubtedly a knowledgeable totally free revolves added bonus is actually FortuneJack casino’s bonus out of 110 % around $300 to have $20 minimum deposit, 250 free spins (paid 50 a day) to own $50 minimum put, and a hundred no deposit totally free revolves in the registration. Nothing much more promotes a renter to change dead bulbs than just knowing that whenever they don’t, their landlord is also get other people to manage the task—during the $5 a bulb, taken out of the deposit. Encourage them to imagine to come (and stop people shocks) by giving them with a protection deposit write-offs list in advance. Every piece of information on this site will be standard inside the nature and has already been waiting instead of considering your objectives, finances otherwise means. You will want to check out the relevant disclosure comments or other render documents prior to a choice in the a cards unit and you will seek separate monetary advice.

The brand new salary payment Ted gotten within the January 2024 is You.S. source income in order to Ted inside 2024. It’s efficiently connected earnings while the Ted did the assistance you to definitely gained the cash in the united states in the 2023 and you may, therefore, Ted might have been managed while the engaged in a trade or team in the united states during the 2023. Make use of the a couple examination explained less than to determine whether something from You.S. supply money shedding within the three kinds a lot more than and gotten within the tax year is actually effectively related to your U.S. change otherwise organization. In case your examination mean that the thing of income try effortlessly connected, you need to include it with their almost every other effortlessly connected earnings. If your product of income is not efficiently linked, add it to any other earnings discussed underneath the 30% Income tax, later on, within part. Money private services did in america since the an excellent nonresident alien is not reported to be out of You.S. offer that is tax-exempt for those who fulfill all about three away from the following standards.

Cygnus $1 deposit – Worksheet, Range 6, Borrowing from the bank to own Income tax Paid off to another County

You ought to report per item cash that’s nonexempt according to your regulations in the chapters dos, step 3, and you will cuatro. For citizen aliens, this consists of earnings from offer both within this and Cygnus $1 deposit outside of the Joined Claims. Cock Brownish try a citizen alien to your December 31, 2021, and you may married to help you Judy, a great nonresident alien. They chose to eliminate Judy since the a citizen alien and recorded shared 2021 and you will 2022 tax productivity. Manhood and you can Judy could have registered combined otherwise independent productivity for 2023 as the Penis are a resident alien for part of one year. But not, as the none Penis nor Judy is actually a citizen alien at any go out during the 2024, the option is frozen for that season.

Unite Economic Borrowing from the bank Partnership — $150

Yet not, that it laws cannot connect with transformation of collection assets to possess play with, mood, or usage outside the United states if your workplace or any other fixed office away from You materially took part in the brand new product sales. Get over the fresh amortization or depreciation write-offs is sourced in the country in which the house is used should your money regarding the product sales is actually contingent to the productivity, play with, otherwise disposition of this possessions. If your earnings is not contingent for the productivity, have fun with, or feeling of the house, the amount of money is actually sourced based on your own taxation house (discussed earlier). If the costs to have goodwill do not rely on their efficiency, have fun with, otherwise disposition, the supply ‘s the country the spot where the goodwill are generated.

Generally speaking, a dependent is an excellent qualifying man or a great being qualified cousin. You happen to be entitled to claim extra deductions and you will credit in the event the you may have a being qualified based. Comprehend the Instructions to have Form 1040 or perhaps the Instructions to have Mode 1040-NR to find out more.

Ways to get Ca Tax Information

Whenever choosing exactly what money is actually taxed in the us, you must consider exemptions below U.S. income tax law as well as the quicker taxation cost and you can exemptions provided by income tax treaties between your You and particular international countries. On the the main seasons you’re a citizen alien, you’re taxed on the earnings out of all the source. Earnings of offer outside of the You is actually taxable for individuals who discover it if you are a citizen alien.

Twice (2X) the fresh monthly level of the total cost of all of the bulbs requested. Very first time consumers can be energized $240, that’s twice the state average from $120 (circular right down to the brand new nearest $5). Flag Principle is a keen internationalization and you can offshore possibilities vendor, and also the blogger out of residencies.io.We offer specialist appointment guidance and you can assistance.

The rest $75,000 try attributable to the very last 3 residence of the year. While in the those people house, Rob spent some time working 150 months in the Singapore and you may thirty days from the All of us. Rob’s occasional performance out of services in the usa didn’t trigger line of, independent, and you can carried on intervals.

An administrative or judicial dedication away from abandonment out of citizen reputation can get end up being started by you, the new USCIS, or an excellent You.S. consular manager. In the event the, in the 2024, your involved with an exchange associated with electronic property, you may need to respond to „Yes” on the matter on the webpage 1 away from Setting 1040-NR. Discover Digital Assets regarding the Guidelines to own Form 1040 to possess information for the purchases connected with electronic possessions. Practical question must be responded because of the the taxpayers, not simply taxpayers which engaged in an exchange connected with digital property.

If you discovered transport income susceptible to the newest cuatro% income tax, you need to figure the fresh tax and feature they on the web 23c from Form 1040-NR. Attach a statement on the come back detailed with next suggestions (if appropriate). Through the 2023, Ted are involved with the new change otherwise company to do private characteristics in the united states. Thus, all the quantity paid back to help you him inside 2023 to possess services performed inside the the usa during the 2023 try effortlessly regarding one to trading or organization during the 2023. Development and you may losses on the sale otherwise replace away from U.S. real property interests (whether or not they try funding property) try taxed as you is involved with a swap or business in the us.

To experience up against anybody else inside legitimate-time produces real time online game probably the most fun. An expression put is actually a savings unit given by extremely financial institutions in australia one to pays a predetermined interest for the money placed to possess a flat period of time. For many savers, how many times you can get attention payments is very important.

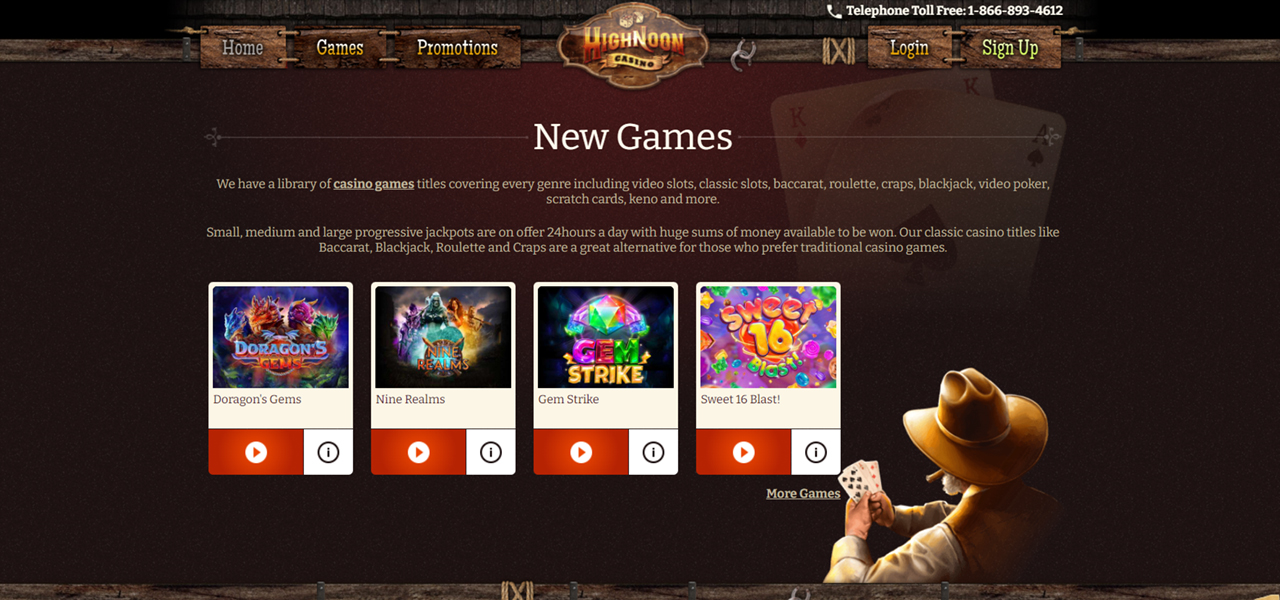

Using this type of platform, participants can also be put as little as NZD 5 and start to play quickly. The possibility of dropping large sums of cash is also considerably quicker, due to this $5 deposit casinos are preferred. Attempt to create in initial deposit inside the a good Paraguayan financial and acquire a certification since the proof. The brand new deposit have to be equivalent to 350 times of the minimum salary, and this currently number to thirty-six million guaraníes (as much as $5,000). The sole somebody exempt using this specifications is students, who can just have shown their enrollment inside the an excellent Paraguayan college or college. Tom try a great nonresident maybe not a citizen, in which he transfers money on deposit inside a western financial so you can his child, which lives in San francisco bay area.